- Charlie Munger reiterates his view on cryptocurrencies.

- He lauds China for executing a full ban on cryptocurrencies.

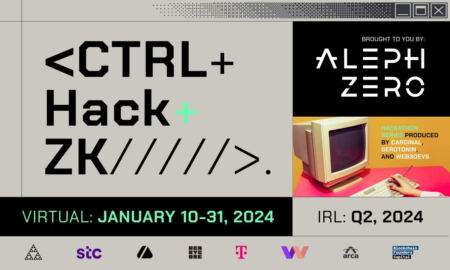

- Cryptocurrencies are having a fantastic start to the new year.

U.S. government should push ahead with an absolute ban on cryptocurrencies, says Charlie Munger – the Vice Chairman of Berkshire Hathaway.

Munger says cryptocurrencies have no real value

Munger has been against cryptocurrencies for the longest time and associates no real value to these assets as they are intangible and unproductive. Reiterating his view in a recent op-ed in the Wall Street Journal, he said:

Crypto is not a currency, commodity, or security. It’s a gambling contract with a nearly 100% edge for the house, entered into in a country where gambling contracts are traditionally regulated only by states that compete in laxity.

Nonetheless, the crypto market seems to be having a fantastic start to the new year with Bitcoin currently up nearly 40% since the start of 2023.

U.S. should learn from the example of China

The influential investor lauded China for recently announcing a strict ban on crypto-related services and urged the United States to learn from its example.

He quoted the ban that England imposed in the early 1700s on all public trading in new common stocks for about a whole century as a precedence as well.

In some cases, a big block of cryptocurrency has been sold to a promotor for almost nothing, after which the public buys in at much higher prices without fully understanding the predilution in favour of the promoter.

It is also noteworthy that his business partner and one of the world’s richest men alive, Warren Buffet, shares his view on the cryptocurrencies as well.